Streamline Your Business: The Power of Xero Payroll Integration

In today’s fast-paced business environment, efficiency is paramount. Companies are constantly seeking ways to optimize their operations, reduce administrative burdens, and focus on core strategic initiatives. One area where significant efficiency gains can be achieved is payroll management. Xero payroll integration offers a powerful solution, seamlessly connecting your accounting software with your payroll processes. This integration eliminates manual data entry, reduces errors, and provides real-time insights into your financial performance.

This article explores the benefits of Xero payroll integration, examining how it can transform your business and improve overall operational efficiency. We’ll delve into the key features, discuss the various integration options, and provide practical advice on how to implement a successful Xero payroll integration strategy.

Understanding Xero and Payroll

Before diving into the specifics of integration, it’s essential to understand the core components involved. Xero is a leading cloud-based accounting software platform designed for small and medium-sized businesses. It offers a comprehensive suite of features, including invoicing, bank reconciliation, expense management, and financial reporting. Its user-friendly interface and robust functionality have made it a popular choice for businesses looking to modernize their accounting processes.

Payroll, on the other hand, is the process of managing employee compensation, including calculating wages, withholding taxes, and issuing paychecks. Payroll compliance is a critical aspect of business operations, as failure to comply with tax regulations can result in significant penalties. Many businesses find payroll management to be a complex and time-consuming task, often requiring specialized expertise. This is where Xero payroll integration becomes invaluable.

The Benefits of Xero Payroll Integration

Integrating your payroll system with Xero offers a multitude of benefits, significantly impacting your business’s efficiency and accuracy.

Reduced Manual Data Entry

One of the most significant advantages of Xero payroll integration is the elimination of manual data entry. Manually transferring payroll data between systems is time-consuming and prone to errors. Integration automates this process, ensuring that payroll information is seamlessly transferred to your accounting records. This saves valuable time and reduces the risk of costly mistakes.

Improved Accuracy

By automating data transfer, Xero payroll integration minimizes the risk of errors associated with manual data entry. Accurate financial records are crucial for making informed business decisions. Integration ensures that your payroll data is consistent and reliable, providing a solid foundation for financial planning and analysis.

Real-Time Financial Insights

Xero payroll integration provides real-time insights into your financial performance. By connecting your payroll data with your accounting records, you gain a comprehensive view of your business’s financial health. This allows you to track labor costs, monitor cash flow, and make informed decisions based on accurate and up-to-date information. You can easily see how payroll affects your bottom line and make adjustments as needed.

Enhanced Compliance

Payroll compliance is a critical concern for businesses of all sizes. Xero payroll integration can help you stay compliant with tax regulations by automating tax calculations and deductions. Many integrated payroll solutions also offer features that help you track employee time and attendance, ensuring that you comply with labor laws. This reduces the risk of penalties and fines associated with non-compliance. [See also: Payroll Compliance Checklist]

Streamlined Reporting

Generating payroll reports can be a time-consuming task. Xero payroll integration simplifies the reporting process by providing access to a range of pre-built reports. You can easily generate reports on payroll expenses, employee earnings, and tax liabilities. These reports can be used for internal analysis, regulatory reporting, and financial planning.

Improved Employee Satisfaction

While seemingly indirect, Xero payroll integration can improve employee satisfaction. Accurate and timely payroll is essential for maintaining employee morale. By automating the payroll process, you can ensure that employees are paid correctly and on time. This reduces the risk of payroll errors and delays, which can negatively impact employee satisfaction. Furthermore, many integrated payroll solutions offer employee self-service portals, allowing employees to access their pay stubs and manage their personal information online.

Types of Xero Payroll Integrations

Several options are available for integrating your payroll system with Xero. The best option for your business will depend on your specific needs and requirements.

Xero Payroll

Xero offers its own built-in payroll module, providing a seamless integration experience. Xero Payroll is designed specifically for use with Xero accounting software, ensuring compatibility and ease of use. It offers a range of features, including automated payroll calculations, tax deductions, and direct deposit. Xero Payroll is a good option for businesses that want a simple and straightforward payroll solution that integrates seamlessly with their accounting software.

Third-Party Payroll Providers

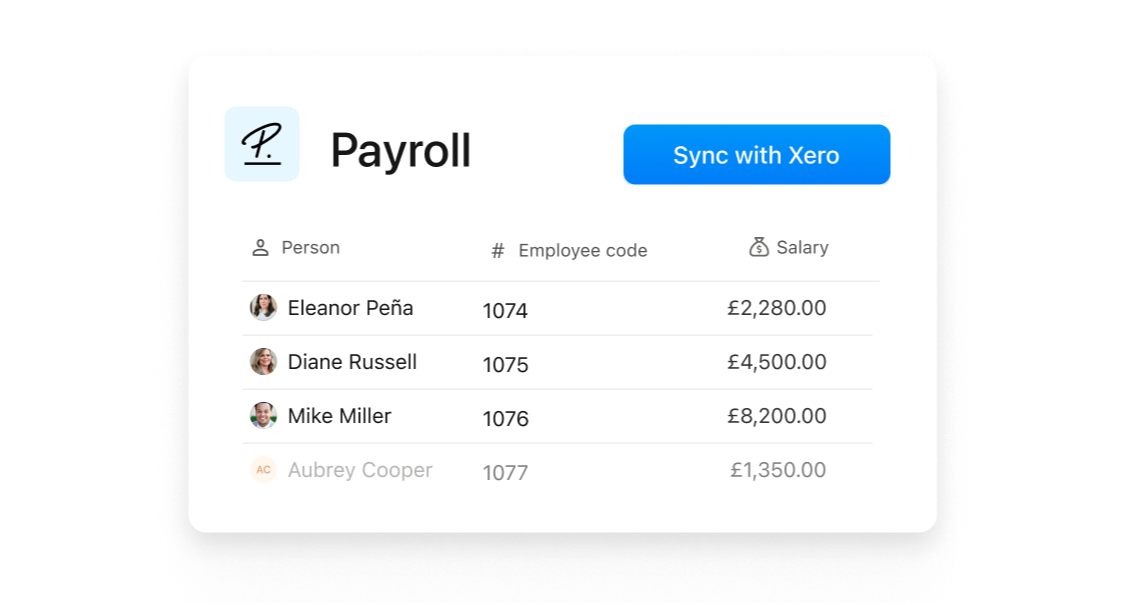

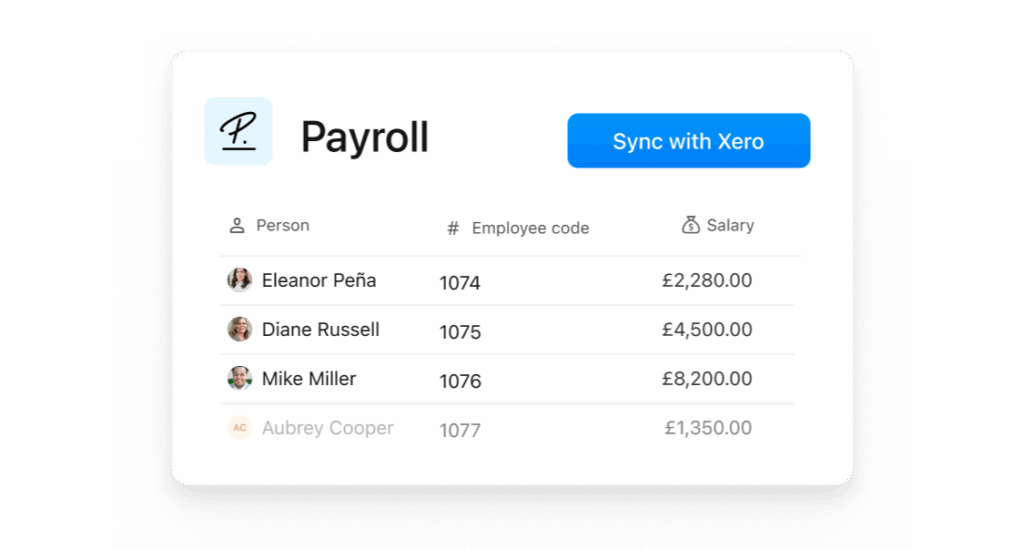

Many third-party payroll providers offer integrations with Xero. These providers specialize in payroll management and offer a wider range of features and services than Xero Payroll. Some popular third-party payroll providers that integrate with Xero include Gusto, ADP, and Paychex. These integrations typically involve connecting your Xero account with your payroll provider’s system, allowing data to be automatically transferred between the two platforms. Choosing a third-party provider often provides advanced features like HR support and benefits administration.

Custom Integrations

For businesses with unique payroll needs, a custom integration may be the best option. Custom integrations involve developing a custom solution that connects your existing payroll system with Xero. This requires technical expertise and can be more expensive than using a pre-built integration. However, it allows you to tailor the integration to your specific requirements. If you have a highly specialized payroll system or need to integrate data in a unique way, a custom integration may be the best choice. [See also: API Integration Best Practices]

Implementing Xero Payroll Integration: A Step-by-Step Guide

Implementing Xero payroll integration requires careful planning and execution. Here’s a step-by-step guide to help you get started:

- Assess Your Needs: Before you begin, take the time to assess your payroll needs and requirements. Consider the size of your business, the complexity of your payroll processes, and your compliance obligations. This will help you determine the best integration option for your business.

- Choose an Integration Option: Based on your needs assessment, choose an integration option that meets your requirements. Consider the features, cost, and ease of use of each option. If you’re using Xero already, Xero payroll is a natural first consideration.

- Set Up Your Accounts: Set up your accounts in both Xero and your chosen payroll system. Ensure that your accounts are properly configured and that all necessary information is entered accurately. This includes employee information, tax information, and bank account details.

- Configure the Integration: Configure the integration between Xero and your payroll system. This typically involves connecting your accounts and mapping data fields. Follow the instructions provided by Xero and your payroll provider to ensure that the integration is properly configured.

- Test the Integration: Before you go live with the integration, test it thoroughly. Run a test payroll to ensure that data is being transferred correctly between Xero and your payroll system. Verify that all calculations are accurate and that all reports are generating correctly.

- Go Live: Once you’ve tested the integration and are confident that it’s working correctly, you can go live. Monitor the integration closely during the first few payroll cycles to ensure that everything is running smoothly.

- Train Your Staff: Provide training to your staff on how to use the integrated system. Ensure that they understand how to enter payroll data, generate reports, and troubleshoot any issues that may arise.

Tips for a Successful Xero Payroll Integration

To ensure a successful Xero payroll integration, consider the following tips:

- Plan Ahead: Don’t rush the integration process. Take the time to plan ahead and ensure that you have a clear understanding of your needs and requirements.

- Choose the Right Integration Option: Select an integration option that meets your specific needs and requirements. Consider the features, cost, and ease of use of each option.

- Ensure Data Accuracy: Data accuracy is crucial for a successful integration. Ensure that all data is entered accurately in both Xero and your payroll system.

- Test Thoroughly: Test the integration thoroughly before you go live. Run a test payroll to ensure that data is being transferred correctly and that all calculations are accurate.

- Provide Training: Provide training to your staff on how to use the integrated system. Ensure that they understand how to enter payroll data, generate reports, and troubleshoot any issues that may arise.

- Seek Support: Don’t hesitate to seek support from Xero or your payroll provider if you encounter any issues. They can provide guidance and assistance to help you resolve any problems.

The Future of Payroll Integration

The future of payroll integration is likely to be driven by advancements in technology, such as artificial intelligence (AI) and machine learning (ML). These technologies have the potential to further automate and streamline the payroll process, reducing manual effort and improving accuracy. AI and ML can be used to automatically identify and correct errors, predict payroll trends, and personalize the employee experience. As technology continues to evolve, Xero payroll integration will become even more powerful and essential for businesses of all sizes.

Conclusion

Xero payroll integration offers a powerful solution for businesses looking to streamline their payroll processes, reduce administrative burdens, and improve overall operational efficiency. By automating data entry, improving accuracy, and providing real-time financial insights, Xero payroll integration can transform your business and help you achieve your financial goals. Whether you choose to use Xero Payroll or integrate with a third-party provider, the benefits of integration are undeniable. By following the steps outlined in this article and implementing best practices, you can ensure a successful Xero payroll integration and unlock the full potential of your business. Embracing Xero payroll integration is a strategic move that positions your company for long-term success in today’s competitive landscape.