How to Calculate Annual Leave Pay: A Comprehensive Guide

Understanding how to calculate annual leave pay is crucial for both employers and employees. Ensuring accurate calculations prevents legal issues and fosters a positive work environment. This comprehensive guide breaks down the various methods and considerations involved in determining annual leave pay, providing clarity and practical examples.

Understanding Annual Leave Entitlement

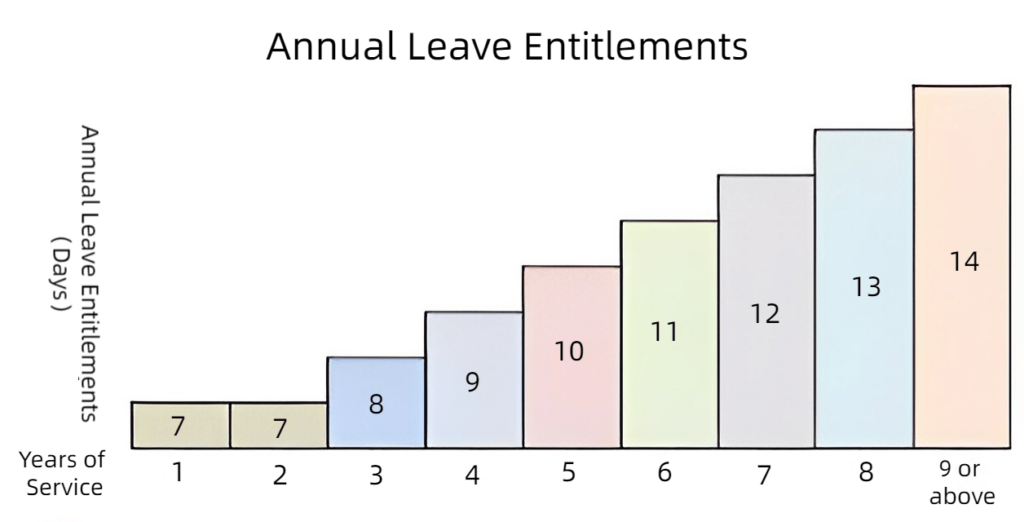

Before diving into the calculations, it’s essential to understand the basic principles of annual leave entitlement. Most countries have laws stipulating the minimum amount of annual leave an employee is entitled to. For instance, in the UK, full-time employees are generally entitled to 5.6 weeks of paid holiday per year. This entitlement may vary based on factors like length of service, industry, and employment contract.

Understanding your local labor laws is the first step in ensuring compliance and fair treatment of employees. Failure to adhere to these regulations can result in legal penalties and damage to your company’s reputation.

Methods for Calculating Annual Leave Pay

There are several methods commonly used to calculate annual leave pay. The most appropriate method depends on the employee’s pay structure and the specific regulations in your jurisdiction.

Fixed Salary Employees

For employees with a fixed salary, the calculation is relatively straightforward. The annual salary is divided by the number of working days in a year to determine the daily rate. This daily rate is then multiplied by the number of leave days taken.

Formula: (Annual Salary / Working Days in a Year) x Number of Leave Days

Example: An employee with an annual salary of $60,000 takes 10 days of annual leave. Assuming there are 260 working days in a year, the calculation would be:

($60,000 / 260) x 10 = $2,307.69

Therefore, the employee’s annual leave pay for those 10 days would be $2,307.69.

Hourly Paid Employees

Calculating annual leave pay for hourly paid employees can be more complex, especially if their hours vary from week to week. A common approach is to calculate the average hourly rate over a specific period (e.g., the past 12 weeks) and use that rate to determine the leave pay.

Formula: (Total Earnings in the Reference Period / Total Hours Worked in the Reference Period) x Number of Leave Hours

Example: An employee earned $12,000 in the past 12 weeks, working a total of 600 hours. They take 40 hours of annual leave. The calculation would be:

($12,000 / 600) x 40 = $800

The employee’s annual leave pay for those 40 hours would be $800.

Employees with Variable Pay

For employees whose pay varies due to commissions, bonuses, or overtime, a more nuanced approach is required. It’s crucial to include these variable components when calculating annual leave pay to ensure a fair representation of their usual earnings.

One method is to calculate the average weekly earnings over a longer period, such as 52 weeks, and use that average to determine the leave pay. This method helps smooth out fluctuations in pay and provides a more accurate reflection of the employee’s typical income.

Formula: (Total Earnings in the 52-Week Period / 52) x Number of Leave Weeks

Example: An employee earned $78,000 in the past 52 weeks, including salary, commissions, and bonuses. They take 2 weeks of annual leave. The calculation would be:

($78,000 / 52) x 2 = $3,000

The employee’s annual leave pay for those 2 weeks would be $3,000.

Key Considerations When Calculating Annual Leave Pay

Several factors can complicate the process of calculating annual leave pay. It’s important to be aware of these considerations to avoid errors and ensure compliance with labor laws.

Inclusion of Overtime

Whether overtime should be included in the calculation depends on the specific regulations in your jurisdiction and the terms of the employment contract. In many cases, regular overtime earnings should be included to reflect the employee’s typical earnings.

Treatment of Bonuses and Commissions

Similar to overtime, the treatment of bonuses and commissions varies. If these payments are a regular part of the employee’s income, they should generally be included in the calculation. However, discretionary bonuses that are not guaranteed may be excluded.

Sick Leave and Public Holidays

It’s important to differentiate between annual leave, sick leave, and public holidays. Employees are typically entitled to paid sick leave and public holidays in addition to their annual leave entitlement. These should not be deducted from their annual leave balance.

Accrual of Annual Leave

Some companies use an accrual system, where employees earn annual leave gradually over time. In this case, the amount of leave available at any given time depends on the employee’s length of service and the accrual rate. Understanding the accrual system is essential for accurately calculating annual leave pay.

Using Technology to Simplify Calculations

Manually calculating annual leave pay can be time-consuming and prone to errors, especially for larger organizations with complex pay structures. Fortunately, various software solutions and payroll systems can automate this process, ensuring accuracy and efficiency.

Payroll Software

Payroll software often includes features for managing annual leave and calculating annual leave pay. These systems can automatically track leave balances, calculate entitlements, and generate reports.

HR Management Systems (HRMS)

HRMS solutions provide a comprehensive suite of tools for managing human resources, including leave management. These systems can integrate with payroll software to streamline the entire process, from requesting leave to calculating annual leave pay.

Spreadsheet Templates

For smaller businesses, spreadsheet templates can be a cost-effective alternative to dedicated software. These templates can be customized to suit specific needs and can automate many of the calculations involved.

Common Mistakes to Avoid

Several common mistakes can lead to errors in calculating annual leave pay. Being aware of these pitfalls can help you avoid them and ensure accurate calculations.

Incorrectly Calculating the Reference Period

Using the wrong reference period for calculating average earnings can significantly impact the accuracy of the leave pay. Ensure you are using the correct period as specified by local regulations and company policy.

Failing to Include Variable Pay Components

Omitting variable pay components like overtime, bonuses, and commissions can result in underpayment of annual leave. Always include these components if they are a regular part of the employee’s income.

Ignoring Changes in Employment Terms

Changes in employment terms, such as promotions or changes in working hours, can affect the calculation of annual leave pay. Be sure to update your calculations to reflect these changes.

Misunderstanding Local Regulations

Failing to understand and comply with local labor laws is a common mistake. Stay up-to-date on the latest regulations and seek legal advice if needed.

Best Practices for Managing Annual Leave

Effective management of annual leave involves more than just calculating annual leave pay. It also includes implementing clear policies, tracking leave balances, and fostering a culture of open communication.

Establish Clear Policies

Develop comprehensive annual leave policies that outline eligibility criteria, accrual rates, request procedures, and payment terms. Communicate these policies clearly to all employees.

Use a Leave Management System

Implement a leave management system to track leave balances, process requests, and generate reports. This system can be manual or automated, depending on the size and complexity of your organization.

Communicate Regularly

Communicate regularly with employees about their leave balances and upcoming deadlines. Encourage them to plan their leave in advance to minimize disruptions to the business.

Ensure Compliance

Stay up-to-date on local labor laws and regulations related to annual leave. Regularly review your policies and procedures to ensure compliance.

Examples of Annual Leave Pay Calculations

To further illustrate the different methods of calculating annual leave pay, here are a few additional examples:

Example 1: Fixed Salary with Accrual

An employee with an annual salary of $72,000 accrues 1.25 days of annual leave per month. After 6 months, they have accrued 7.5 days of leave. Their daily rate is $72,000 / 260 = $276.92. Their annual leave pay for those 7.5 days would be $276.92 x 7.5 = $2,076.90.

Example 2: Hourly Paid with Variable Hours

An employee earned $15,000 in the past 12 weeks, working a total of 750 hours. They take 32 hours of annual leave. Their hourly rate is $15,000 / 750 = $20. Their annual leave pay for those 32 hours would be $20 x 32 = $640.

Example 3: Salary Plus Commission

An employee earned a base salary of $50,000 plus $10,000 in commissions in the past 52 weeks, for a total of $60,000. They take 3 weeks of annual leave. Their average weekly earnings are $60,000 / 52 = $1,153.85. Their annual leave pay for those 3 weeks would be $1,153.85 x 3 = $3,461.55.

Conclusion

Calculating annual leave pay accurately is essential for maintaining compliance and fostering a positive employee-employer relationship. By understanding the different methods, considering key factors, and leveraging technology, you can ensure fair and accurate calculations. Remember to stay informed about local regulations and seek professional advice when needed. Mastering how to calculate annual leave pay benefits both the employee and the employer, promoting transparency and trust within the workplace. [See also: Employee Rights and Entitlements] [See also: Payroll Management Best Practices]