Understanding ACH Deposit TPG: A Comprehensive Guide

In the realm of financial transactions, understanding the intricacies of different payment methods is crucial. One such method that frequently appears, especially in the context of tax refunds and government payments, is the ACH deposit TPG. This article aims to provide a comprehensive understanding of what ACH deposit TPG entails, how it works, and what you need to know about it.

What is ACH?

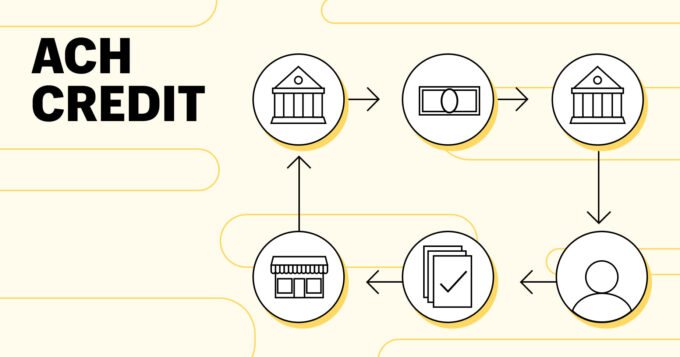

Before diving into the specifics of ACH deposit TPG, it’s important to understand the basics of ACH. ACH stands for Automated Clearing House, which is a nationwide network that coordinates electronic payments and automated money transfers. It’s a system used for a wide variety of financial transactions, including direct deposit of paychecks, bill payments, and government benefits. The ACH network is governed by Nacha, formerly known as the National Automated Clearing House Association, which sets the rules and standards for ACH transactions.

Defining TPG in the Context of ACH Deposits

TPG, or Tax Products Group, is a company that facilitates the processing of tax refunds and related financial products. TPG often works as an intermediary between taxpayers, tax preparers, and the IRS to ensure smooth and efficient handling of tax refund disbursements. When you see “ACH deposit TPG” on your bank statement, it generally means that your tax refund or a portion thereof has been processed through Tax Products Group via an Automated Clearing House transfer.

How ACH Deposit TPG Works

The process of an ACH deposit TPG typically involves several steps:

- Tax Preparation: You file your taxes, either on your own or through a tax preparer.

- Refund Processing: If you are due a refund, the IRS processes your tax return.

- TPG Involvement: If you opted for certain services, such as paying your tax preparation fees directly from your refund, TPG may be involved. The IRS sends the refund to TPG.

- Fee Deduction: TPG deducts any agreed-upon fees for tax preparation or other services.

- ACH Transfer: The remaining balance of your refund is then sent to your bank account via an ACH transfer. This is the “ACH deposit TPG” that you see on your statement.

Common Reasons for Seeing ACH Deposit TPG

There are several reasons why you might see an ACH deposit TPG on your bank statement:

- Tax Refund: The most common reason is that you received your tax refund, and it was processed through TPG.

- Fee Payment: You may have chosen to pay your tax preparation fees directly from your refund. TPG facilitates this by deducting the fees before sending the remaining amount to you.

- Refund Transfer Products: Some tax preparation services offer refund transfer products, where the refund is used to pay for tax preparation fees and other related services. TPG often handles these transactions.

Understanding Fees Associated with TPG

It’s important to be aware of any fees associated with using TPG’s services. These fees can vary depending on the tax preparer and the specific services you choose. Common fees include:

- Refund Transfer Fee: A fee for using a refund transfer product.

- Tax Preparation Fee: The cost of having your taxes prepared by a professional.

- Other Service Fees: Fees for additional services, such as audit protection or identity theft protection.

Always review the fee schedule provided by your tax preparer and TPG to understand exactly what you are paying for.

How to Verify an ACH Deposit TPG

If you’re unsure about an ACH deposit TPG on your bank statement, there are several ways to verify it:

- Check Your Tax Documents: Review your tax return and any related documents from your tax preparer. These documents should outline how your refund was processed and any fees that were deducted.

- Contact Your Tax Preparer: Your tax preparer can provide detailed information about the services you used and the fees you paid.

- Contact TPG Directly: You can contact TPG directly for information about your specific transaction. They typically have a customer service line or online portal where you can inquire about your refund.

- Check the IRS Website: The IRS website offers tools and resources for tracking your refund and understanding how it was processed.

Potential Issues and How to Resolve Them

While ACH deposit TPG transactions are generally smooth, issues can sometimes arise. Here are some potential problems and how to address them:

- Unexpected Fees: If you notice fees that you were not aware of, contact your tax preparer and TPG to inquire about them. Review your agreement to ensure that the fees are legitimate.

- Delayed Refund: If your refund is delayed, check the IRS website for updates on your refund status. Contact TPG and your tax preparer to see if there are any issues on their end.

- Incorrect Deposit Amount: If the amount deposited is incorrect, contact TPG immediately. They can investigate the discrepancy and take corrective action.

- Unauthorized Transaction: If you believe that the ACH deposit TPG was unauthorized, contact your bank immediately to report the issue and take steps to protect your account.

The Benefits and Drawbacks of Using TPG

Using TPG for tax refund processing has both benefits and drawbacks:

Benefits:

- Convenience: It allows you to pay for tax preparation services directly from your refund.

- Efficiency: It streamlines the refund process, ensuring that you receive your funds quickly.

- Accessibility: It provides access to various financial products and services related to tax preparation.

Drawbacks:

- Fees: Using TPG can incur additional fees, which can reduce the amount of your refund.

- Complexity: The process can be complex, making it difficult to understand exactly what you are paying for.

- Potential Delays: While it aims for efficiency, there is always a potential for delays due to various factors.

Alternatives to Using TPG

If you’re not comfortable using TPG or want to avoid the associated fees, there are alternative ways to handle your tax refund:

- Direct Deposit: Have your refund directly deposited into your bank account by providing your bank details to the IRS.

- Check by Mail: Request a paper check from the IRS, which will be mailed to your address.

- Pay Tax Preparation Fees Upfront: Pay your tax preparation fees upfront to avoid using refund transfer products.

Understanding ACH Transactions in General

Beyond tax refunds, ACH transactions are a fundamental part of modern financial life. Understanding how they work can help you manage your finances more effectively.

Types of ACH Transactions:

- Direct Deposit: Employers use ACH to deposit paychecks directly into employees’ bank accounts.

- Direct Payment: Consumers use ACH to pay bills online or set up recurring payments.

- Business-to-Business (B2B) Payments: Businesses use ACH to pay vendors and suppliers.

- Government Payments: Government agencies use ACH to distribute benefits, such as Social Security payments.

Benefits of ACH Transactions:

- Convenience: ACH transactions are convenient and easy to use.

- Efficiency: They are faster and more efficient than traditional payment methods, such as checks.

- Security: ACH transactions are secure and reliable.

- Cost-Effective: They are often less expensive than other payment methods.

The Future of ACH Payments

The ACH network continues to evolve, with ongoing efforts to improve speed, security, and efficiency. Same Day ACH, for example, allows for faster processing of certain ACH transactions. As technology advances, ACH payments are likely to become even more integrated into our daily lives. [See also: Understanding Same Day ACH]

Conclusion

Understanding ACH deposit TPG is essential for anyone who files taxes and receives a refund. By knowing how this process works, you can make informed decisions about how to handle your tax refund and avoid any unexpected fees or delays. Whether you choose to use TPG or opt for an alternative method, being informed is the key to a smooth and efficient tax refund experience. Always review your tax documents, understand the fees involved, and verify any transactions on your bank statement to ensure accuracy and security.

In summary, an ACH deposit TPG represents a tax refund or a portion thereof processed through Tax Products Group via the Automated Clearing House network. Staying informed about the process, associated fees, and your options can lead to a more transparent and satisfactory tax season.